Business Challenge

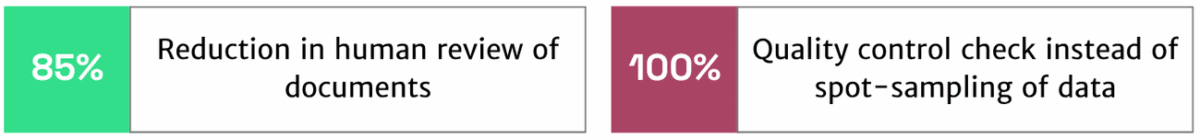

A leading loan originator needed to reduce the human effort required to review documents that were submitted by customers using the company’s online portal. Traditional OCR technologies lacked automation and failed to meet the firm’s accuracy standards. Borrowers were becoming frustrated with delays in processing their mortgage applications.

TRUE’s Solution

Using the advanced document classification capabilities of TRUE Data Intelligence, the company deployed automated processes that are very fast, accurate, and more reliable than their existing semi-manual processes. TRUE’s lending intelligence solution helped the loan originator to deliver real-time feedback to borrowers on the accuracy of the documents they submitted. The solution also provided an unparalleled and holistic understanding of borrowers, helping the company accelerate mortgage processing and dramatically improve customer satisfaction.

Business Impact

Make Financial Decisions with Intelligence

Our mortgage origination solutions are designed for lightning-fast lending. Learn more about how they work to drive intelligent decisions.