Business Challenge

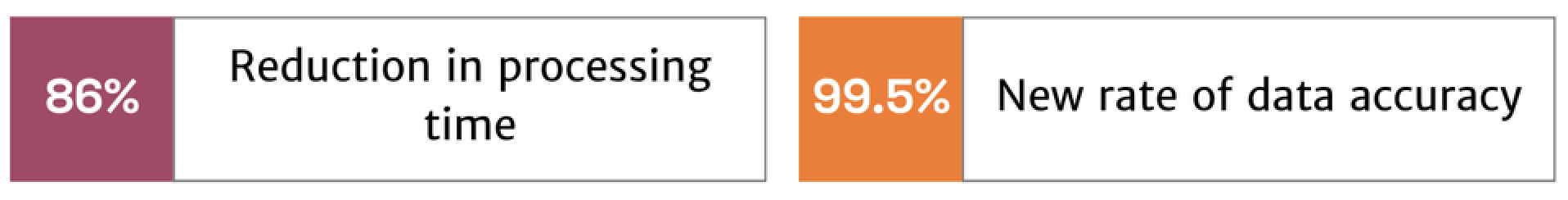

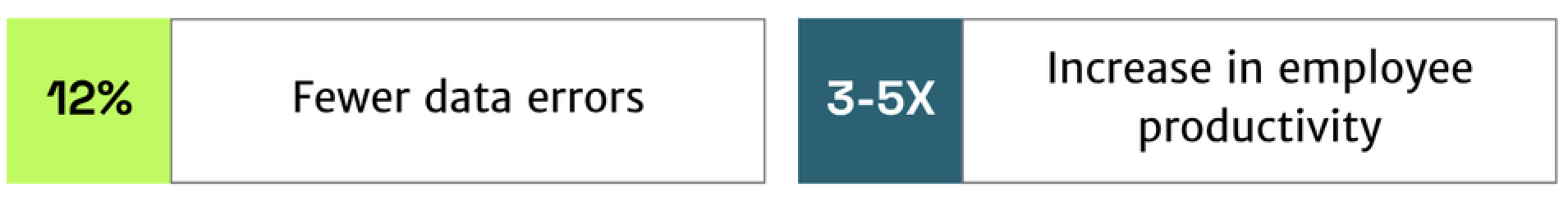

Facing an increasingly competitive market, a leading mortgage insurance firm needed help automating the manual processing of 500,000 pages of unstructured data per week. Lengthy cycle times and poor data accuracy were putting pressure on the company’s bottom line.

TRUE’s Solution

Using a lending intelligence solution from TRUE, the company automated many manual tasks performed by underwriters. Advanced machine learning and AI capabilities helped the business inspect, analyze, and audit every data point in every field throughout every document instead of sampling data as it had in the past. TRUE Data Verification helped the company overcome anomalies, inconsistencies, and risk while boosting underwriter productivity and reducing errors and processing time.

Business Impact

Make Financial Decisions with Intelligence

Our solutions provide support for a wide range of lending and financial services needs. Learn more about how they work with the TRUE Platform to drive intelligent decisions.