There’s a lot of AI hype these days, and it’s sometimes hard to separate fact from fiction. Walk through the exhibit hall at any major mortgage industry conference in 2024 and you’d think Artificial Intelligence (AI) – especially generative AI (GenAI) – had already reinvented the mortgage business. Vendor booths promise instant underwriting, document automation, chatbot-driven borrower engagement, and streamlined closings. But if you zoom out to the industry’s actual performance metrics, it’s hard to find signs of a revolution.

Freddie Mac reports that average mortgage origination costs have climbed more than 35% over the past three years, now hovering around $11,000 per loan. The average time to close a loan still ranges from 30 to 45 days, only marginally improved from a decade ago. Despite all the AI hype, most borrowers still submit paystubs and W-2s manually, wait days for underwriting decisions, and sign thick closing packets.

So where is the AI revolution? Is it a myth, marketing exaggeration, or is it actually happening – but only for a select tech-savvy few?

In this blog, we feature some new survey data from National Mortgage News and HousingWire to answer these questions and explore where the mortgage industry is making real progress with AI – and where it’s still hitting roadblocks. You’ll see both the opportunities and the barriers reported directly by mortgage professionals.

Signs of Real ROI

Dig into the mortgage industry stats and a more nuanced picture emerges. Some of the largest and most tech-forward lenders are manufacturing loans at less than half the industry’s average cost. They’re achieving faster cycle times and better net margins, even in a down market. These leaders have invested heavily in automation, intelligent data extraction, predictive underwriting, and even GenAI copilots to support staff.

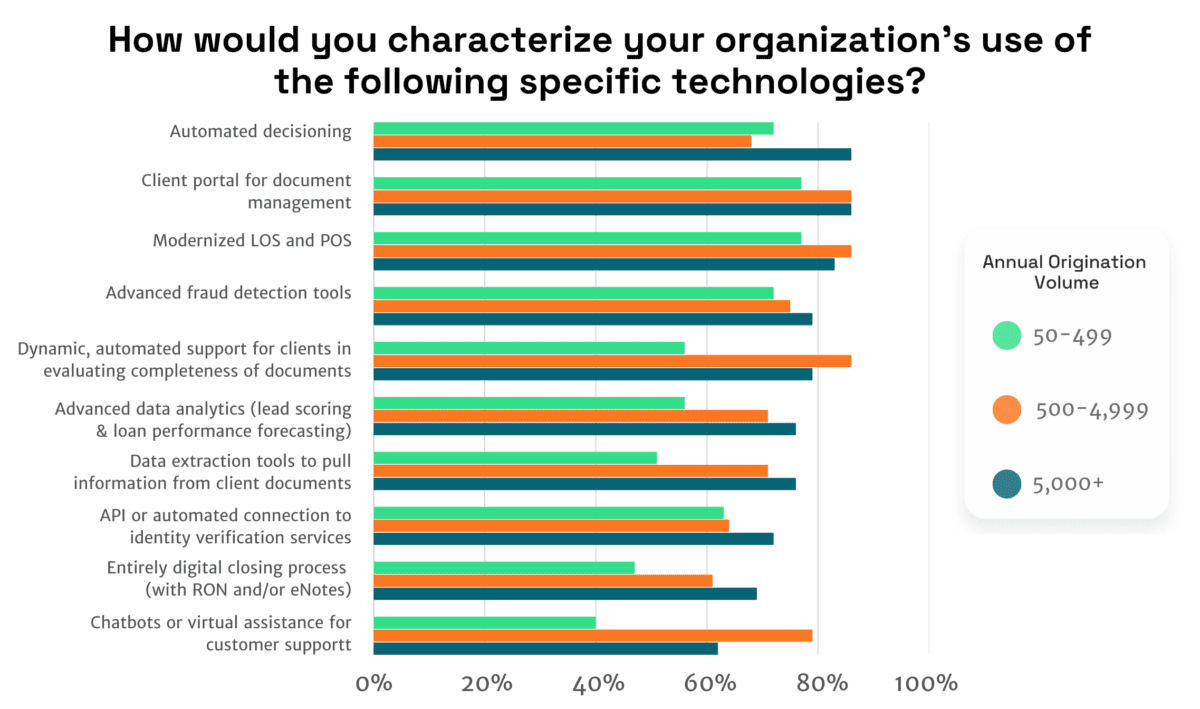

The graph below, drawn from our recent National Mortgage News survey, shows which technologies lenders are actively deploying across different organizational sizes. From automated decisioning and document management portals to advanced fraud detection and digital closing tools, the data reveals a clear pattern: larger lenders are more likely to have adopted these innovations, giving them a meaningful operational edge.

For these tech-savvy, forward-thinking few, AI isn’t a future promise – it’s already delivering real productivity gains. For instance:

- Automated document indexing and data extraction is reducing loan prep time by up to a week. Example: Rocket Mortgage uses an AI-powered document automation platform to process bank statements, pay stubs, and tax forms. This has streamlined their document intake and classification, taking multiple days off the initial loan setup process.

- Automated income and asset verification is shaving off days from the underwriting process. Example: Better Mortgage leverages real-time income and asset verification, enabling them to skip manual document gathering and reduce underwriting time by several days.

- AI-driven document review is reducing post-close audit times from 45 minutes per file to under 10 minutes. Example: Mr. Cooper used an AI-based solution to automatically review documentation and conditions across loan files, cutting audit times dramatically while improving quality control.

- ML-based credit models are enabling lenders to approve more borrowers at the same risk threshold. Example: Upstart, a fintech lender, partners with banks and credit unions like Cross River Bank and BankMobile, using machine learning credit decisioning models that expand access to credit while maintaining loss rates on par with traditional FICO-based underwriting.

- Internal AI copilots are helping staff navigate guidelines, surface loan conditions, and summarize exceptions in seconds. Example: Guild Mortgage uses Truework and internal AI copilots built with Microsoft Azure AI to help loan officers and underwriters query guidelines and generate condition summaries instantly — improving both speed and compliance.

One large national lender reportedly used a suite of AI tools to reduce its per-loan fulfillment costs by more than 50%, while improving defect rates and customer satisfaction. Clearly, AI is working for some tech-savvy lenders that know where and how to utilize this technology.

Why Isn’t It Working Everywhere?

If AI is so powerful, why hasn’t it lifted the entire home lending industry?

The answer lies in a mix of product fit, integration, change management, and broader organizational and industry constraints. AI tools don’t magically lower costs or accelerate workflows on their own — to deliver real value, they need to be applied to well-defined use cases (not boil the ocean) and embedded within operational processes.

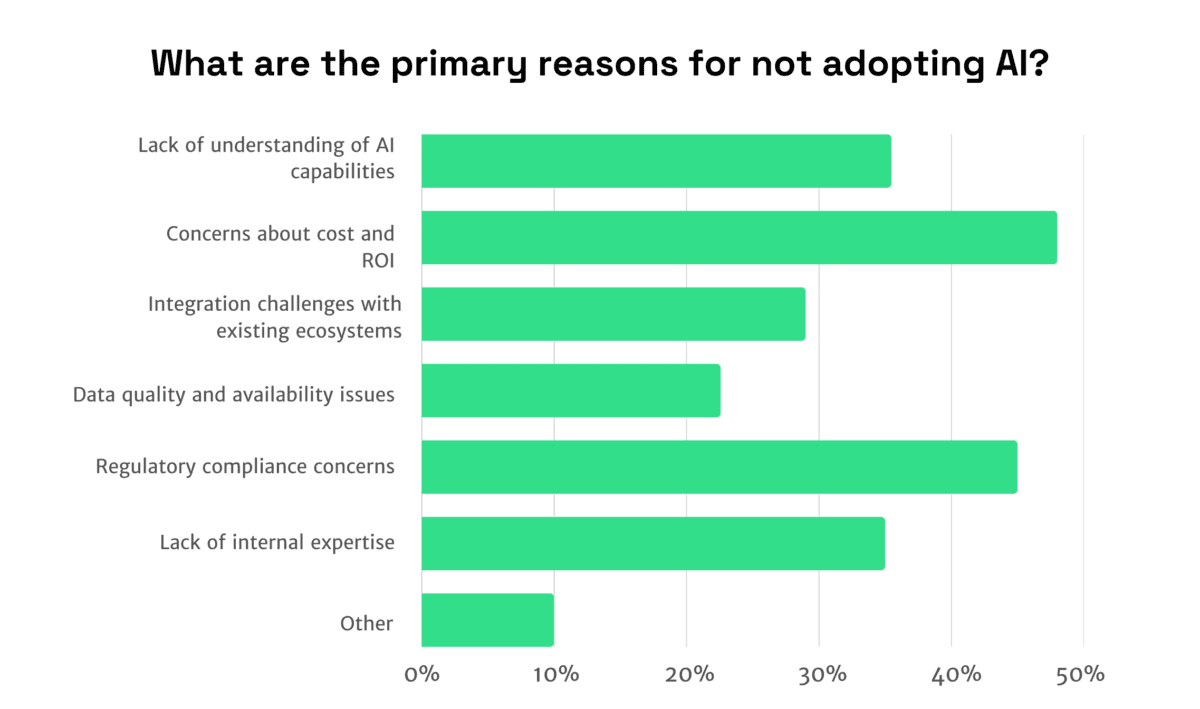

Our recent survey with HousingWire (see chart below) highlights the primary reasons AI for mortgage lenders isn’t being adopted. Common barriers include integration challenges, lack of resources, cultural resistance, regulatory concerns, and risk aversion. These factors are especially acute among smaller and mid-sized lenders, who often lack centralized teams, robust data infrastructure, and dedicated innovation budgets that larger players rely on to make AI implementation feasible.

Smaller and mid-sized lenders, in contrast, often face:

- Fragmented, legacy systems that lack integration, making end-to-end automation difficult.

- Under-resourced IT teams and limited budgets, creating cost and bandwidth constraints.

- Institutional resistance to change, including entrenched manual workarounds, long-standing LO compensation structures, and cultural norms of “this is how we’ve always done it.”

- Compliance and regulatory complexity, where uncertainty around explainability, auditability, and governance slows or blocks AI adoption, especially in sensitive areas like underwriting or borrower communications.

- Legal and institutional risk aversion, where fear of introducing errors, inviting scrutiny, or increasing liability creates hesitation at the executive level.

Even when AI tools are technically available, turning them into measurable ROI generally requires process redesign, regulatory alignment, retraining of staff, and clear executive sponsorship. Without this, the tools often remain siloed, underutilized, or — worse — add layers of complexity without delivering the promised gains.

The Real Bottleneck: Change, Not Tech

Ironically, the biggest bottleneck in AI adoption may not be the technology itself – it’s often the human systems wrapped around it. Many AI tools today are good enough to reduce cost and time. But they work best when paired with lean operations, clear accountability, and a willingness to rethink legacy workflows.

The top-performing lenders are reengineering the mortgage process around AI – from first touch to post-close. They’re using GenAI to generate customer-facing communications, surface insights for processors, and accelerate loan conditioning. But more importantly, they’re breaking down silos, flattening hierarchies, and aligning incentives around throughput and quality.

They’re not waiting for perfect tech. They’re building adaptive organizations ready to benefit from tech as it evolves.

Where Do We Go From Here?

The gap between the AI “haves” and “have-nots” in mortgage lending is likely to widen in 2025. Lenders who treat AI as a bolt-on feature will struggle. Those who treat it as a lever for redesigning the entire lending process will thrive.

There’s good news though. The playbook for using AI effectively to optimize the home lending process is emerging. Start by focusing AI efforts on high-friction, high-labor areas like document intake, income calculation, and QC review. Then layer in predictive analytics and GenAI to assist – not replace – knowledge workers. Finally, invest in training, workflow reengineering, and cross-functional change management.

AI is not a silver bullet – but it is a powerful lever. The revolution isn’t fake – it’s real and it’s happening. Lenders who figure out how to harness the power of AI effectively, and can utilize it operationally to reduce loan decisioning time and cost, will be the ones who win.

Join the Conversation!

Our biweekly LinkedIn newsletter discusses how these AI solutions are transforming document processing, risk management, and overall efficiency in the mortgage industry. Join us to learn about the future of AI in home lending.