Steve Butler here – Any lender considering using AI in their operations should ask this question first. The answer will determine level of adoption of the AI solutions and the return on investment the lender realizes.

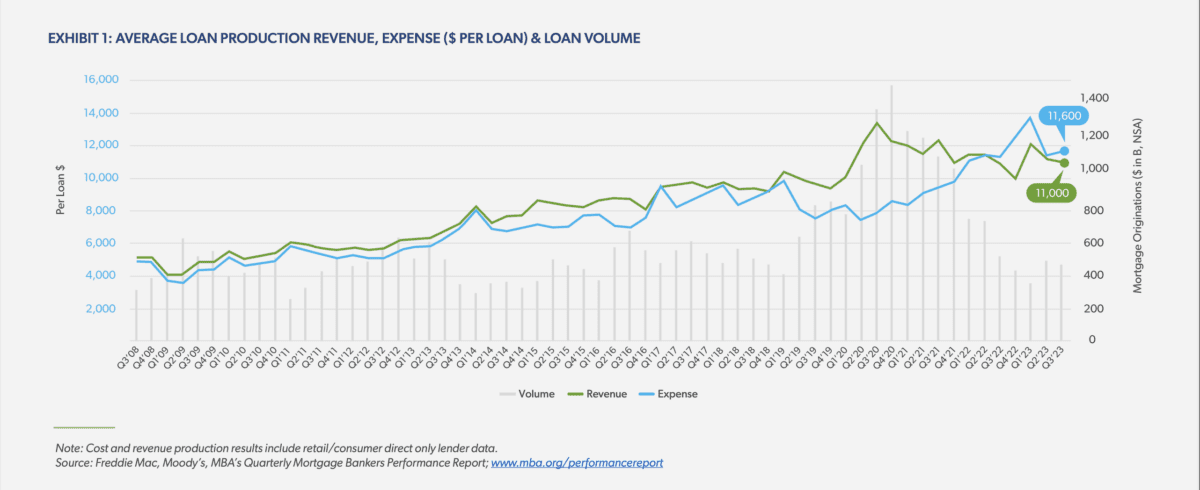

We’ve seen the charts. Loan manufacturing is struggling! For more than 20 years the cost to manufacture a mortgage has grown year after year. Today the average cost is $11,000 to manufacture a loan, increasing by 35% in just the past 3 years.

Source: Freddie Mac 2024 Cost to Originate Study

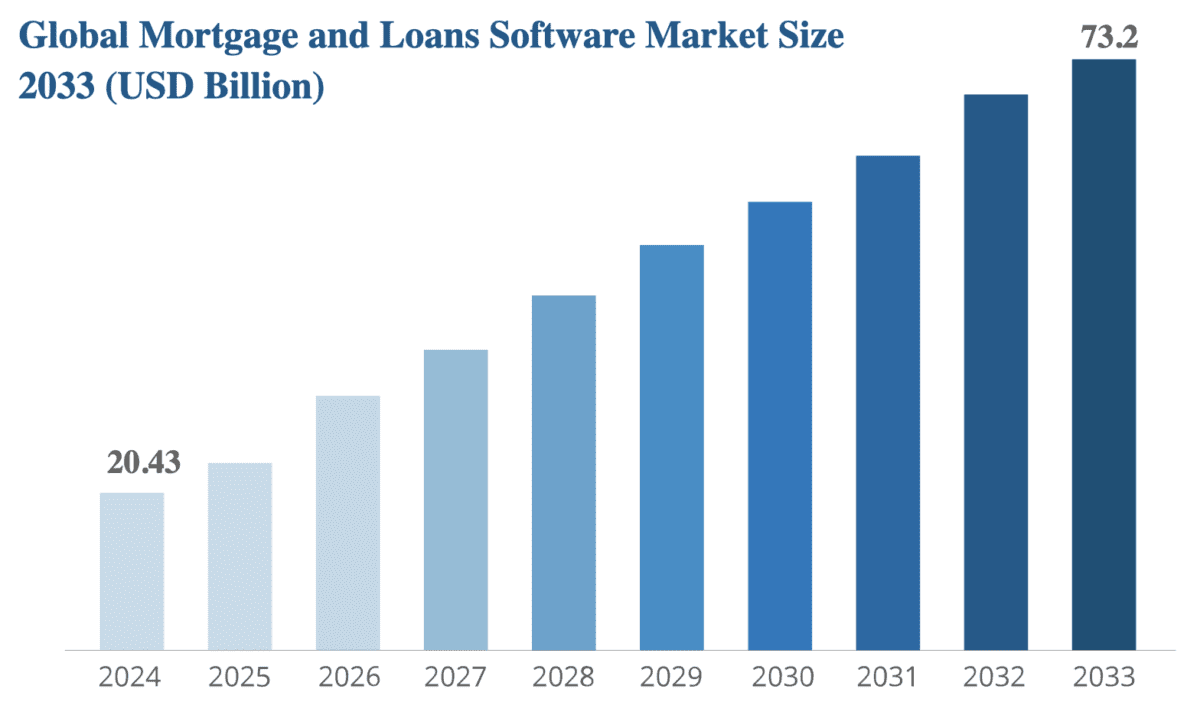

Mortgage Tech Tool Investments are High

What’s especially troubling to the lender C-suite is that they have been investing heavily for years in software tools to “bend this curve” and lower operating costs. LOS’s, CRMs, POS’s, underwriting tools, and defect tracking tools are just some of the dozens of tools lenders have been investing in. As shown in the chart more than $20B annually is spent on mortgage tech software on a global basis. That majority of this spending is in the US. Yet, costs keep rising!

Source: Business Research Insights’ Mortgage and Loans Software Market Report

Productivity from Software Tools Lower Than You Think

Leading consultant, McKinsey, has been studying productivity gains for technology investments for decades. According to a recent report by McKinsey, in the past 15 years, “productivity growth has averaged just 1.5 percent, even as incredible advances in digital technology put a supercomputer in every pocket. Over the past decade, software has demonstrably boosted productivity, but the specific gains vary across sectors and depend on factors like IT maturity and the type of software used. While some reports suggest productivity gains of 60% or more with tools like AI, overall, productivity growth has slowed.”

Three conclusions from the report caught my attention-

- The average annual productivity gains from software tools are at the 1-2% level.

- Productivity gains have stalled recently.

- The prediction for productivity gains from AI are far higher (60% or higher).

Software tools don’t come for free for the user. Mortgage tech tools are especially complex, requiring training, configuring, integrating, updating, and in many cases specializing. In fact, lenders may grow their staff to accommodate tool specialists. Regardless, while software tools boost productivity, the real ROI is tamped down from the burden the user takes on to learn and maintain expertise on the tool. A significant percentage of the user’s time is spent on the tool and not on the lender’s workflow. Hence, it’s no wonder the productivity gain % from software tools are measured in single digits. And this explains well why loan manufacturing costs keep rising year after year.

The Promise of AI as a Background Worker

If lenders are not careful, AI tools may disappoint them in a similar way. AI tools that need training, configuring, and human correction of results most certainly will. When AI solutions lack either sufficient mortgage intelligence or are applied to poor fit use cases, the result is typically underwhelming and sometimes even a drag on operations.

What if AI could act as a background worker—quietly, reliably, and independently completing tasks without burdening your lending team? The departments deploying these AI background workers (loan officers, processors, underwriting, closing) do not have to review the results from the AI, do not need to train the AI, and are not required to manage or provide any oversight of the AI background worker. For this to be the case, the AI solution is applied to a specific use case that it can fully automate without involving the users. In short, the AI background worker is a highly trained specialist and self-sufficient worker.

In this scenario, significant ROI occurs because the output from the AI background worker is pure gain. Great examples of AI background workers automating tedious mortgage manufacturing tasks, are TRUE’s Instant Index and Instant Extract solutions.

These AI solutions don’t require constant oversight, retraining, or manual review. Instead, function like a highly trained specialist that automates specific, well-defined tasks end-to-end. TRUE Instant Index and Instant Extract seamlessly handling document classification and data extraction without human intervention.

With background AI for lending, loan officers and processors are no longer bogged down by time-consuming tasks like indexing, labeling, or “stare and compare” QC work. Underwriting can begin faster, loans close sooner, and teams redirect their time toward higher-value activities. With AI-powered mortgage workflows,, TRUE helps lenders reduce processing costs, improve accuracy, and significantly accelerate time to loan quality.

So, is your AI a tool or a background worker?

Join the Conversation!

Our biweekly newsletter explores where AI technology is going for mortgage lenders, specific use cases, and the “smarter, not harder” approach to innovation.