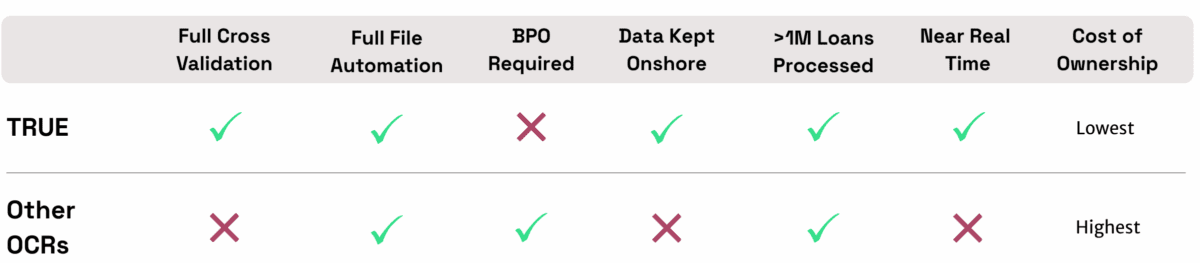

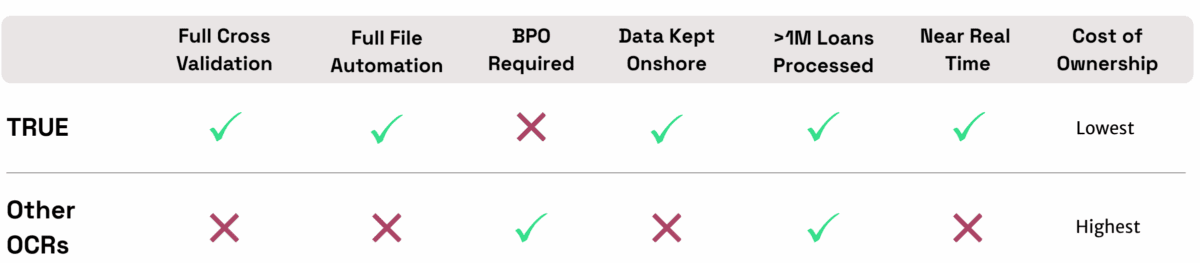

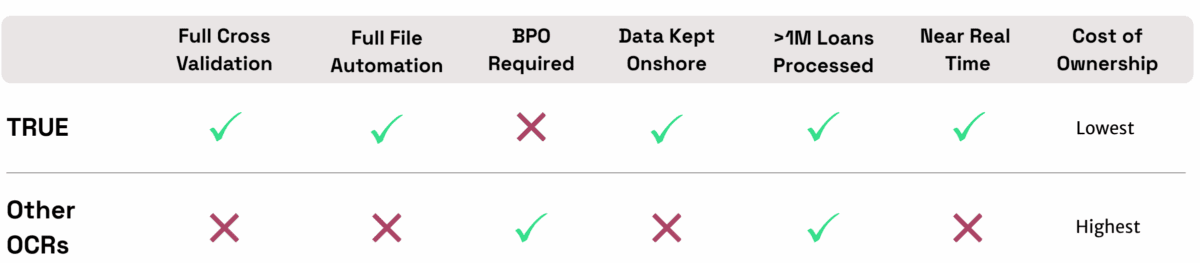

Real Automation for Modern Mortgage Teams: The Breakdown

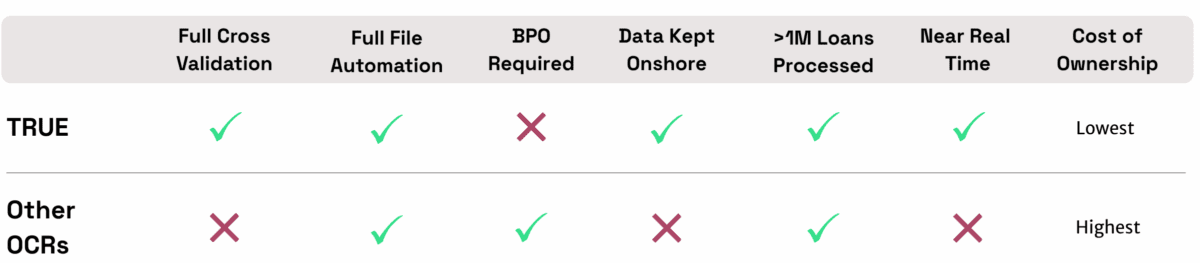

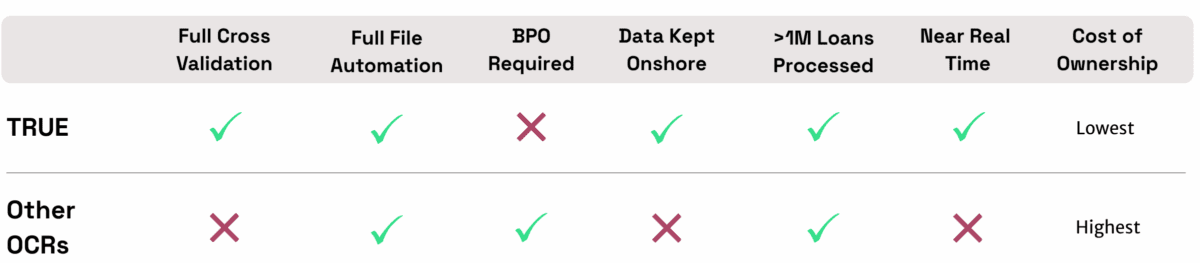

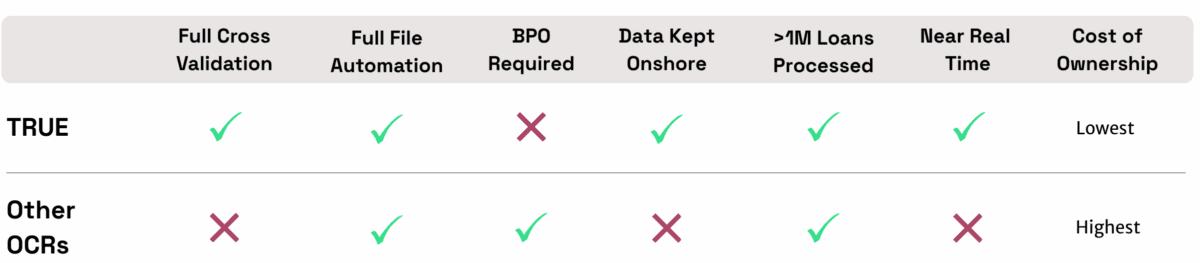

Imagine your loan files moving through “automated” systems but half the work is still being done by people behind the scenes. Documents wait in queues. Data gets re-keyed. Turn times stretch while your team scrambles to verify what’s already been verified. This is what you get with Optical Character Recognition (OCR) technology.

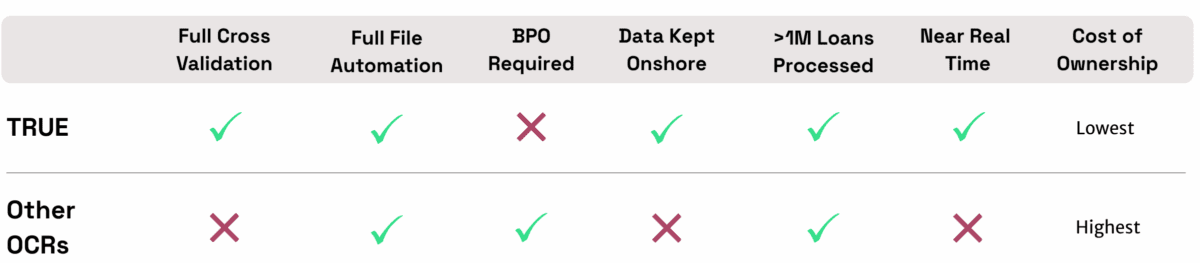

TRUE solves that problem. It’s built for real automation — not optical character recognition dressed up as AI. Every document, every data point, every validation step connects seamlessly from intake to decision, with no offshore review or hidden human workflows.

And there’s another reason lenders searching for better automation come to TRUE: you get faster closings, lower cost of ownership, and complete confidence in your data.

Let’s see how they compare.

Document Indexing

Traditional OCR tools still rely on staff to sort and classify borrower documents, slowing down the process and creating errors. TRUE automatically identifies and organizes every file the moment it’s received, keeping loans moving without manual effort.

Documents Filing & Naming

Manual naming and inconsistent filing make it hard for teams to find what they need and stay audit-ready. TRUE applies consistent, rule-based naming conventions and structure automatically, ensuring every document is easy to locate and verify.

Data Extraction

OCR captures text but misses meaning, leaving teams to review, correct, and re-enter key details. TRUE extracts clean, structured data in real time — no templates or human review — ready to flow directly into your LOS.

Data Validation Between Documents & LOS

When OCR tools can’t cross-check data, discrepancies surface late in underwriting, triggering costly rework. TRUE validates every field instantly across documents and systems, preventing issues before they slow a file.

Fraud Detection

Relying on human review for fraud detection exposes lenders to risk and inconsistency. TRUE automatically flags tampering, mismatched data, and anomalies before they reach underwriting, protecting your pipeline.

Income Analysis for W2

Traditional OCR forces teams to re-calculate and verify income manually, adding hours of back-and-forth. TRUE automates W2 income analysis with precise calculations and audit-ready documentation in seconds.

Income Analysis Self-Employed

Analyzing self-employed borrowers often means tedious manual reviews across multiple documents. TRUE automatically extracts, standardizes, and analyzes complex income data, delivering consistent results lenders can trust.

Borrower Assets Analysis

Manually reviewing bank statements for deposits and balances slows decisioning and increases errors. TRUE extracts and verifies asset data automatically, helping lenders validate borrower funds in a fraction of the time.

Borrower Eligibility Recommendation

OCR leaves eligibility decisions scattered across spreadsheets and systems. TRUE unifies verified data from income, assets, and credit to deliver real-time borrower eligibility insights that streamline underwriting.

UW Conditions Clearing

Clearing conditions with OCR still depends on manual validation and repeated uploads. TRUE automatically verifies documents and data against underwriting requirements, resolving conditions faster and getting loans to close sooner.

Ready to see TRUE In Action?

Experience Touchless Automation with fewer surprises, faster closings, and a smarter, scalable mortgage operation.