Why the closing disclosure timeline is where ‘fast close’ plans go to die

Every lender wants a ‘shorter cycle time.’ Then the deal hits the last mile, someone finds a fee cure, a tolerance issue, or a mis-read payoff, and the closing disclosure timeline becomes the bottleneck everyone remembers.

The irony is that the Closing Disclosure (CD) itself is straightforward. What’s hard is manufacturing a CD you can stand behind, across variable data quality, vendor handoffs, and late-stage changes.

If you are in mortgage operations, technology, strategy, production, or underwriting, our goal is to define bottlenecks within the closing disclosure timeline, and find solutions that actually keep closings on schedule.

Closing disclosure timeline: the rule in plain terms

The CFPB frames in plain terms:

‘Lenders are required to provide your Closing Disclosure three business days before your scheduled closing.’

From a lender lens, ‘provide’ is not the same as ‘receive’ and delivery method matters. That means your disclosure workflow is not just a doc event, but an intensive logistics event with proof, timing, and auditability. The CFPB’s TILA-RESPA Integrated Disclosure (TRID) FAQs also state that the creditor must ensure the consumer receives the initial Closing Disclosure no later than three business days before consummation, and then clarifies how corrections work.

The CFPB also lists the three buckets that trigger a new three business-day waiting period for a corrected CD:

- APR becomes inaccurate

- Loan product information becomes inaccurate

- A prepayment penalty is added

Everything else still needs a corrected CD, yet it can typically be received at or before consummation.

Closing disclosure timeline: what actually breaks in production

Most delays are not “TRID problems.” They’re data problems and workflow problems that show up as TRID problems.

Here’s the pattern I see most often:

- Data arrives late (or arrives early but is unreliable).

- Teams do manual validation and reconciliation.

- Exceptions stack up near close.

- Fees shift, payoffs change, APR moves, or the product parameters are reworked.

- Redisclosure happens, and your closing disclosure timeline slips.

This is what “data supply chain” looks like in plain terms. Documents hit the file, AI sorts them, extracts key fields, and cross-checks them so the downstream steps do not turn into cleanup work at the end.

This is why “faster close” initiatives that focus only on the closing desk tend to disappoint. By the time you’re drawing docs, most of the outcome is already baked in.

The ‘human review’ tax that shows up at the end

Many document and data vendors still rely on a human-in-the-loop model for assurance.

That approach can work, yet it introduces two late-stage risks:

- Turn times you don’t fully control when volumes spike

- Variability in how edge cases are handled, which surfaces as exceptions near close

TRUE’s CEO Stephen Butler puts it more bluntly:

Legacy OCR often needed humans to ‘clean up’ results, adding time, cost, and risk.

Here is the operational difference in one minute. When AI is confident, humans review fewer fields. That is what prevents last-mile pileups.

This difference matters specifically for the closing disclosure timeline because the CD is downstream of everything. If your docs-to-data step is slow or inconsistent, you feel it at closing.

A loan manufacturing playbook to protect the close

True’s underlying principle around the loan manufacturing process can be summed up as below:

Treat the CD like an output of your data supply chain, not a form your closing team produces.

1. Lock the data earlier than you think

Your team does not need a final CD on day minus three. They need a stable dataset that makes the CD predictable.

Speed is not the goal by itself. Speed with trusted inputs is what prevents rework. This clip explains why clean data changes cycle time.

TRUE’s ‘Trusted Lending Data’ framing is useful here: decisioning depends on the quality of digital data, supported by documents or trusted third-party sources, and “garbage in, garbage out” applies.

When your dataset stabilizes earlier, two things happen:

- Your fee and cash-to-close swings shrink

- Your redisclosure frequency drops, because fewer “surprises” exist late

2. Move exception detection upstream

TRUE describes ‘Background AI’ that runs in the background and flags issues early without forcing users into yet another UI. That’s the right deployment model for CD risk reduction, because closers don’t need more screens. They need fewer surprises.

A practical approach:

- Ingest borrower, third-party, and settlement docs continuously

- Extract and validate key fields that drive fees, cash-to-close, APR movement, and product constraints

- Surface discrepancies as soon as they appear, while there is still time to fix them without resetting the clock

3. Reduce rework by removing ‘copy-paste’ work

From a closing disclosure timeline perspective, that “trusted data layer” is the lever. CDs slip when the file’s underlying data is unstable. Build stability, and the CD becomes boring again.

TRUE’s differentiation is the ‘trusted data’ layer across the lending lifecycle, plus a strong emphasis on machine-only automation and onshore processing for income and document understanding.

4. Define the three ‘clock reset’ guardrails

If you want a clean executive dashboard, don’t start with twenty metrics. Start with these three guardrails tied to the CFPB triggers:

- APR drift risk: anything that would move APR beyond tolerances late

- Product parameter drift: changes to product attributes that require redisclosure

- Prepayment penalty changes: rare, but treat as red-alert

Then map each guardrail to upstream root causes (fees, payoffs, lender credits, last-minute seller concessions, data mismatches, and so on).

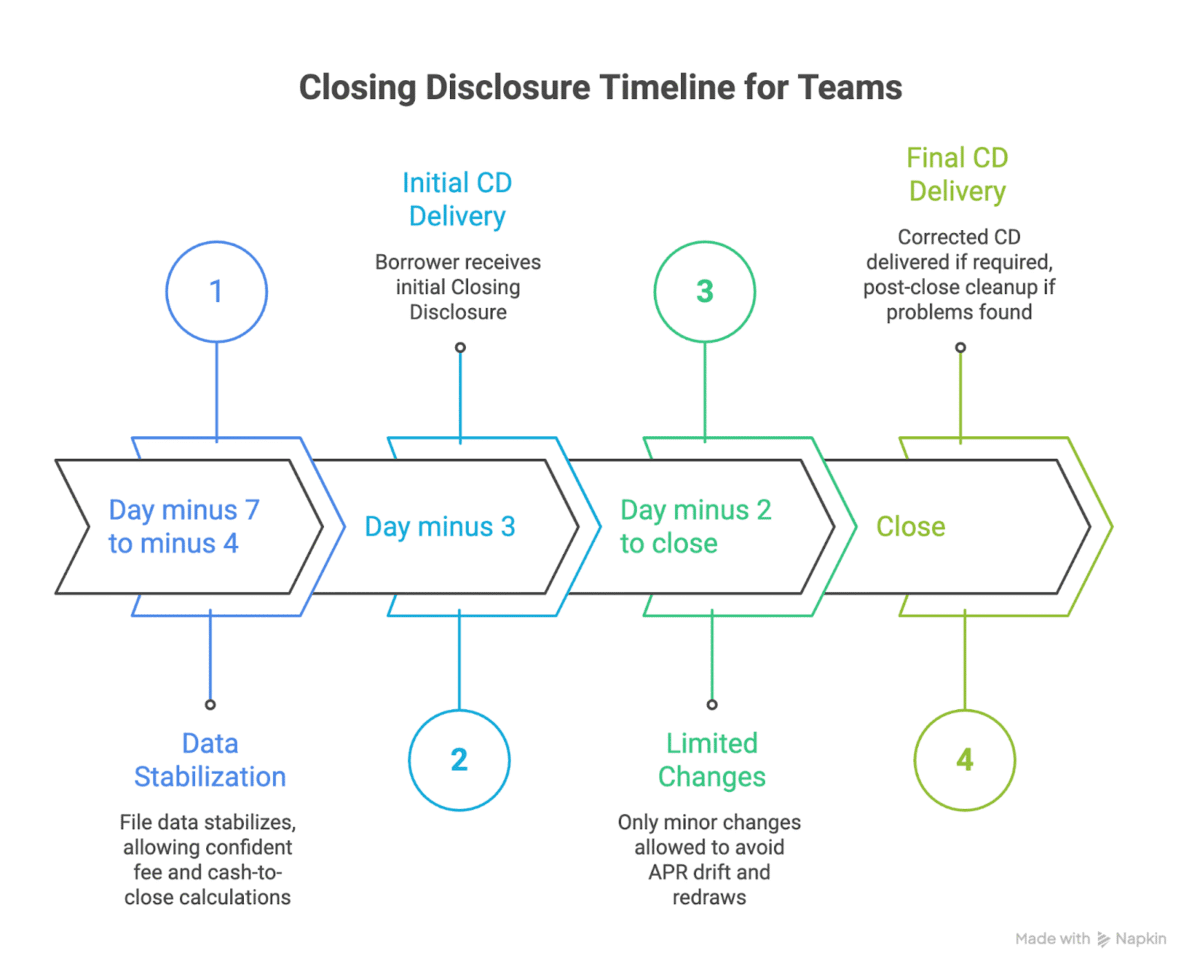

A practical timeline map you can use with your teams

Here’s a simple way to explain the closing disclosure timeline inside your org, with the parts that usually matter operationally.

| Window | What must be true | What tends to break |

| Day minus 7 to minus 4 | File data stabilizes enough for confident fee and cash-to-close | Missing docs, late payoffs, fees moving across vendors |

| Day minus 3 | Borrower receives initial CD | Delivery/receipt proof gaps, late changes that force redraw |

| Day minus 2 to close | Only limited changes should occur | APR drift, product changes, fee cures, rebalancing credits |

| Close | Corrected CD delivered if required | Post-close cleanup because problems were found too late |

The ‘win’ is not heroic on day minus two. The win is stability at day minus seven.

KPIs and governance for executives

If you want this to move, you need shared accountability across ops, tech, and production.

Here are metrics that actually drive behavior:

- % of loans with CD redisclosure (and the reason codes mapped to the CFPB trigger buckets)

- Average time from ‘data-complete’ to initial CD (this exposes data supply chain drag)

- Exception discovery timing (how many exceptions are found inside the last 72 hours)

- Fee cure frequency (tie directly to systems, vendors, and handoffs)

Then set governance rules:

- No “late change” without an owner and reason code

- No vendor handoff without traceability

- No AI output without audit visibility (teams trust what they can inspect)

How TRUE helps to shorten Closing Disclosure cycle time

So, in CD terms, the strategy is:

- Use AI to convert docs to reliable data early

- Use AI to detect anomalies and inconsistencies continuously

- Feed your LOS and closing stack with cleaner inputs so your CD is not a reconciliation project

TRUE’s end-to-end mortgage automation platform lowers the lender’s cost per loan, and shortening the Closing Disclosure cycle is a key step to that objective.